ETFs are highly popular among (small) investors. Traders have invested 43 billion euros net in ETFs in 2014. The total assets invested in European ETFs amounted to 379 billion euros at the end of 2014, of which 257 billion euros were in equity ETFs (source: Morningstar).

We would recommend small investors to use ETFs as a basis for their share portfolio, as a very good diversification can be achieved with just a few securities and little capital investment.

To buy or sell ETFs, you need a broker. To choose the right one for you, you can use our clearly structured comparison calculator – we particularly recommend the offers of OnVista (free DAX-ETF savings plans) and CapTrader.

How do I select the best and cheapest DAX-ETF?

Basically, we would recommend considering the following 3 aspects when selecting your DAX-ETF:

- Make sure the ETF physically replicates – keep your hands off swap-replicating ETFs

- Have a look at the costs! The TER (Total Expense Ratio) shows how much the ETF costs you per year. The higher the TER, the greater the proportion of fund income that does not go to you

- Look at the quality of the ETF! Even though ETFs are passive investments, they differ in quality. The tracking error indicates how accurately the ETF replicates the performance of the index (e.g.: DAX).

Which DAX-ETF is the cheapest?

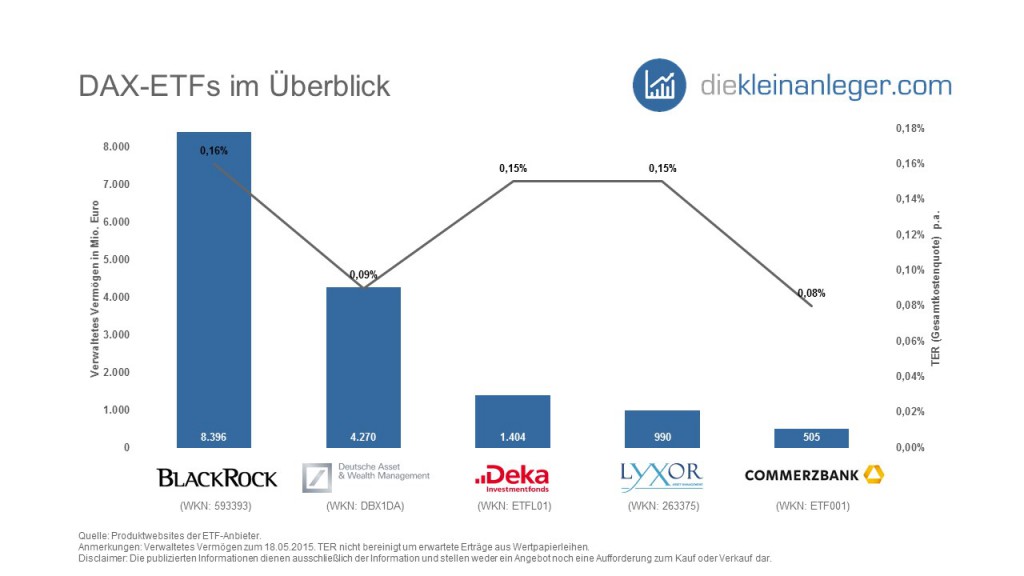

The following table contains important information on the five publicly available ETFs on the DAX.

| Name | ISIN/WKN | TER | AUM (€m) | Fund manager | Launch date |

| iShares Core DAX® UCITS ETF (DE) | DE0005933931 593393 | 0,16% | 8.396 | BlackRock Asset Management (Black Rock) | 27.12.2000 |

| DAX® UCITS ETF (DR) 1C | LU0274211480 DBX1DA | 0,09% | 4.270 | Deutsche Asset & Wealth Management (Deutsche Bank) | 10.01.2007 |

| Deka DAX® UCITS ETF | DE000ETFL011 ETFL01 | 0,15% | 1.404 | Deka Investment (Deka) | 14.03.2008 |

| LYXOR UCITS ETF DAX | LU0252633754 263375 | 0,15% | 990 | Lyxor (Société Générale) | 28.06.2006 |

| DAX ® TR UCITS ETF | LU0378438732 ETF001 | 0,08% | 505 | ComStage (Commerzbank) | 21.08.2008 |

The ETF market is very competitive. Morningstar estimates that the break-even TER lies at 10 to 14 basis points (i.e. 0.10% to 0.14%) – so two of the funds would even make operational losses. The strategy behind this is that a DAX-ETF – as we have suggested – forms the basis in many portfolios. With other ETFs, which an investor may buy later, this loss should be compensated.

Simply because ETFs are a very inexpensive way of investment, they are often left out of the bank’s advice – ETFs simply do not generate enough sales commission.

So anyone who informs him/herself, can save high fees with little effort and still achieve the yield of the DAX.

Which DAX-ETF is the best one?

The quality of an ETF is best estimated with the tracking error. It expresses by how much the ETF has missed its target – i.e. by how much the fund has performed worse (or better) than the DAX. If the DAX rises by 10% in one year, but the ETF by only 9.9%, the tracking error this year is 0.10% or 10 basis points.

The following table shows the current tracking errors (as of 13. May 2015) of the DAX ETFs presented above since their launch date. The tracking error p.a. is intended to provide a better comparison of the individual funds.

| Name | Launch date | DAX since beginning | ETF since beginning | Tracking Error | Tracking Error p.a. |

| iShares Core DAX® UCITS ETF (DE) | 27.12.2000 | 81,67% | 76,82% | 4,86% | 0,33% |

| DAX® UCITS ETF (DR) 1C | 10.01.2007 | 15,94% | 13,97% | 1,97% | 0,23% |

| Deka DAX® UCITS ETF | 14.03.2008 | 14,48% | 14,23% | 0,25% | 0,03% |

| LYXOR UCITS ETF DAX | 28.06.2006 | * | |||

| DAX ® TR UCITS ETF | 21.08.2008 | 83,54% | 81,77% | 1,77% | 0,26% |

*For the Lyxor Fund (Société Générale), we were unfortunately unable to provide you with the tracking error with the information available on the product website.

Of course, the tracking error should always be as low as possible. You should be aware, however, that past performance does not allow to draw any clear conclusions about future performance.

What causes the tracking error?

The tracking error is essentially influenced by the following 5 aspects:

- TER: Even if the ETF itself performs well, the fund management expenses have to be covered during the year, which of course reduce the fund’s assets (and thus its performance).

- Transaction costs: Since these are not included in the TER, they also reduce fund performance. Extraordinary transaction costs can arise as a result of rebalancing, e.g. if the ETF has to buy or sell securities due to index changes.

- Sampling: If the index contains a large number of securities (e.g. the Russell 2000 with the 2000 smallest companies of the Russell 3000), the fund manager may not buy all securities in the exact same proportion, as the transaction costs do not exceed the added value of exact replication. This also creates a difference in performance, which can also be positive.

- Cash drag: If the fund is a distributing fund (i.e. generally not DAX ETFs, as the DAX itself reinvests), there are usually delays between reception and distribution of dividends/revenues. In the meantime, this cash generates a yield that can be positive or negative.

- Lending of securities: A physically replicating index fund occasionally lends securities to other financial market members (e.g.: short sellers). These loans also generate a return.

Excursion: Lending of securities

Some fund companies pass on 100% of the income from their lending transactions, others keep a small part of the income. The largest DAX-ETF provider, BlackRock, has published an information brochure outlining the concept of securities lending.

Of course, there is still a risk involved in securities lending, despite hedging with high-quality securities. The counterparty can go bankrupt and consequently not return the lent security. BlackRock says that they have only faced such a situation three times since 1981. In each of these three cases, however, the securities lent could be repurchased without loss.

BlackRock passes on 60% of the income from the securities lending business to the fund.

Which DAX-ETF can we recommend?

With this information, you should be perfectly equipped to select the best and cheapest DAX-ETF for you. We do not want to influence your choice too much.

In principle, we prefer established providers to smaller ones. However, small investors should alaways pay attention to the TER. A final check should be the tracking error – if it is within a reasonable range, you are ready to go!

To save unnecessary costs and fees for your broker, we recommend using our comparison calculator. We would especially like to recommend OnVista‘s offer, with which you can even trade various ETF savings plans for free and the offer of CapTrader.

If you have any questions, please do not hesitate to contact us!

| Custody account | Costs per order |

|---|---|

| 3,99 |

| 4,00 |

| 4,95 |

Anzeige

One Comment