No one would buy a house without taking out insurance against the most common dangers (fire insurance, burglary insurance, household insurance).

What is the biggest risk with shares? Of course, the price loss! One could now believe that there is no insurance against price losses for something as complex as shares on the stock exchange, right?

You are wrong here! In this article, we will explain how you can hedge your shares against price losses.

There are two possibilities. The simple variety is a so-called stop-loss order. In this case, the shares are sold automatically as soon as the price falls below a certain limit: you can find more on this topic here. However, hedging with a stop-loss order cannot be regarded as real hedging but rather as a prevention of high losses – the proper but more complicated method follows here:

How does hedging against price losses work in theory?

Example 1: Buying a share without insurance

Let’s assume you buy 100 shares of XYZ AG for 50 euros per share. Should the value of the share fall to 0 euros, you lose 5,000 euros – total loss!

If the price drops to 40 euros, you lose 1,000 euros. If the price rises, you gain.

This is certainly not new to you. If you still have difficulties with this topic, we recommend that you first read through the other articles on the subject of shares.

Example 2: Buying a share with insurance

The shares and the price risk in example 1 remain the same. However, you also buy options for the shares.

What are options?

With an option you acquire the right, but not the obligation, to buy (call option) or sell (put option) a certain amount of a share (underlying) at a predetermined price.

Options are usually referred to as gambling instruments or highly speculative derivatives. However, options were developed to determine the future purchase or sale price of a share already today.

This means that an option can be used to secure a price. This process is also known as hedging. This is also where the word “hedge fund” originates – this is a fund that trades or speculates with these instruments. However, we do not want to speculate, but to use options rationally.

In order to successfully deal with options, we need a few basic terms:

- Strike price: The price at which you can buy (call) or sell (put) a share.

- Strike day: The day by which you have to exercise your option the latest.

- American option: For American options, you can exercise an option any day up to strike day.

- European options: For European options, you can only exercise an option on strike day.

- Contract size: You can usually only buy options in larger quantities – e.g. for 50 or 100 shares (or many more). Buying an option for a single share simply does not make sense due to fees and expenses.

- Duration of insurance: The period of time until strike-day can be regarded as your insurance period. Your course is secured/insured until strike day. After that, you would have to buy new puts to hedge your shares again.

In order to be able to buy options for hedging at all, you need a broker. We recommend using a low-cost online discount broker that does not charge any running fees and offers low order fees. We can highly recommend OnVista‘s offer. For more information, you can also read our OnVista test report.

How does insuring a share work?

You buy an arbitrary share and a corresponding American put option (for the same share). As explained above, this put option entitles you to sell your shares at a predetermined price. Practical, isn’t it?

You can buy options at several strike prices on the stock exchanges. If you buy the stock from example 1 for 50 euros and a put option with strike 40, your risk of price loss is limited to 10 euros. If the price falls below 40, you can simply exercise your option and sell your stock for 40 euros.

You can also buy a put option with a strike of 50 euros and completely remove the risk of price loss.

Of course, you do not get share insurance for free. As for any insurance, you have to pay an insurance premium; for options, the option premium.

Let us stick to the example with the put option at a strike of 50. If this option costs 5 euros, your insurance costs amount to 10% of the purchase price.

But this also means that your stock must rise by at least 10% before you make a profit. That is the price for your safety!

Since you have acquired the right but not the obligation to exercise the option, you will not exercise your options if the share price rises above the strike price. Why should you sell at a lower price than you could sell on the stock exchange?

How does hedging against price losses work in practice?

So that you can put this knowledge into practice, we will show you how you can hedge against price losses using a simple share.

We have been monitoring the share price of Erste Group Bank (Sparkasse in Austria) for some time. We have decided that we want to buy a total of 100 shares at a price below 15.50 euros.

Additionally, we consider hedging the share at a price of 15 euros (options are usually only offered in 1 euro steps). Our maximum price loss risk is therefore 50 cents per share or a total of 50 euros.

If we bought puts at a strike price of 14 euros, we would risk a price loss of a maximum of 1.50 euros per share or a total of 150 euros – but we do not want that.

Using this link you can see all options for Erste Group Bank on the Vienna Stock Exchange.

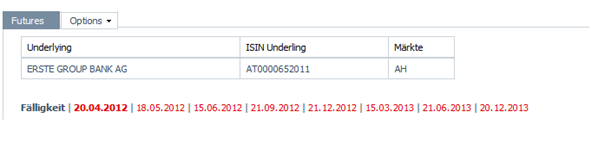

This chart shows that various due dates (from April 20, 2012 to December 20, 2013) are traded.

Since these are American options, you can determine your insurance period yourself.

The idea behind this example is to be secured until 20.12.2013. But currently, there are no rates for these options. This is mainly due to the fact that the Austrian stock market is a relatively small market. For American stocks, however, we may already be able to acquire such options.

The latest date is December 21, 2012. The volatility – i.e. the fluctuations – are generally greater for options than for shares. This is illustrated by the example below:

This is mainly due to the rare price formation – only for the “14 put”, the price was last determined in April. This means that these options are not very liquid. This is usually extremely unfavourable for shares, as illiquid shares can only be turned back into cash slowly and with a high risk of price losses.

If you only use options for hedging, however, it does not matter too much, as you only want to hold the option and not speculate with it.

We need a “15 put”, which would currently cost 4.21 euros – or 27% of our purchase limit (15.50 euros). This is of course far too much, but this price is already 3 months old – the next price will probably be between “Bid” and “Ask”, i.e. around 1.95 euros or 13 % of the purchase price.

This would mean that the share would have to rise by at least 13% within 8 months (our insurance period) in order for us to be able to cover the costs of the insurance.

Under which circumstances do we recommend hedging share prices with put options?

- If the hedging costs per year would not have exceeded 5 %, we would have bought the options for Erste Bank.

- If the share has been flying high and you are not sure whether this performance was just due to speculation or not.

- If you have invested a significant amount in a single stock and a loss would be a big risk for you.

- If you buy the stock in a time of (corporate) crisis and think that the stock could either fall or rise sharply.

So you have seen that there are a number of reasons to insure shares. In our example, we have finally decided against it because the costs would simply be too high. Furthermore, in our opinion, the share is very attractive and we think that it will not fall too much anymore.

However, this assessment is only based on our modest opinions. This information is not intended as a recommendation to buy or sell.

Anzeige