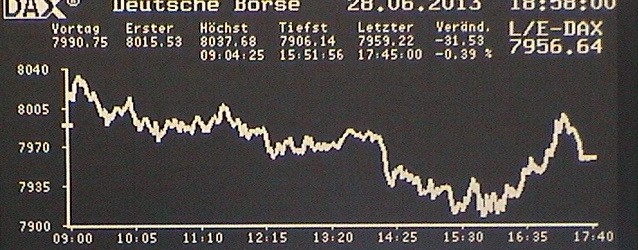

Lately, the DAX has repeatedly broken its record high. As we have described here, we do not believe that the DAX is currently overvalued, but this article is not about whether one should invest in the DAX, but how one can invest in the DAX.

Finding DAX index funds

An index fund buys all shares contained in an index (e.g. the DAX) according to their actual weighting in the index. So you can buy all shares in an index with relatively low fees and small available capital (thus this also suitable for small investors). General information on index funds can be found here.

Consequently, anyone who wants to invest in the entire DAX can do so cost-effectively via an index fund. It is important to ensure that you invest in a fully replicating fund (which actually buys the securities) and do not buy a SWAP-based product.

If we stick to our DAX example, the issue with swap-based index funds is that they do not buy the shares of the DAX but simply bet on the share price.

Basically, this does not change the operating principle of the index fund, since the DAX can also be represented by betting. In a bet, however, there is a counterparty which can go bankrupt. This means that your fund can win the bet, but the counterparty can then become insolvent and your fund cannot assert its profit claims.

Due to the so called counterparty risk, we do not see a reason to buy a swap-based index, when we can get a fully replicating fund.

Index funds to choose from

Using the Morningstar ETF Rating Tool to compare the available DAX index funds, we would like to present you the two best results:

| Costs (TER) | WKN | |

| ComStage ETF DAX | 0,08 % | ETF001 |

| iShares DAX | 0,15 % | 593393 |

In both cases, the costs are limited, so it is only a matter of taste which of the two funds you buy. It will not change your yield much, because 0.04% more or less yield per year is almost negligible.

What is not negligible, however, is where you buy these funds.

Buying a DAX index fund

Index funds are usually also Exchange Traded Funds (ETF). Although this name sounds complicated, it merely means that these funds are traded on the stock exchange and therefore do not include any issue premiums, but only the usual order fees.

If you already have a broker, you can find the corresponding fund by entering the respective security identification number and then buy it on the stock exchange.

If you do not have a broker yet, you can simply open one for free. We recommend the OnVista Broker, which offers very low fees:

Open an OnVista fund custody account

Basically, funds can also be purchased through the house bank or other financial institutions, but in most cases there are incredibly high fees and custody costs. Therefore, this option is not recommended for small investors.

Broker-comparison calculator: how you can buy DAX index funds at the lowest price!

Beste Broker-Angebote

Der erste Schritt zum Investment in Aktien, Anleihen, Fonds oder ETFs ist die kostenlose Eröffnung eines Broker-Accounts.

| Depot-Konto | Kosten je Order |

|---|---|

| € 2,00 + 0,018% | |

| € 3,99 |

| € 5,00 |

Risikofreie Eröffnung - keine laufenden oder Fixkosten (keine Depotgebühren)